Lawrence County has been issued a tenative property assessment equalization factor of 1.000 according to the Illinois Department of Revenue.

The factor is often called the "multiplier". It is the method used to achieve uniform property assessments among counties, as required by law. State law requires property in Illinois to be assessed at 1/3 of its market value. Farm property in Illinois is assessed differently. Assessments here in Lawrence County at at 33.74% of market values, based on sales of properties in 2020, 2021 and 2022.

The factor currently being assigned to Lawrence County is for 2023 taxes payable in 2024. Last year, the equalization factor for the county was also 1.000.

SW Parke School Board votes to close Montezuma Elementary

SW Parke School Board votes to close Montezuma Elementary

Groundbreaking for $10B Meta data center campus at LEAP District

Groundbreaking for $10B Meta data center campus at LEAP District

Indiana to receive over $6M in EpiPen settlement

Indiana to receive over $6M in EpiPen settlement

Monrovia enters regional clash knowing what to expect

Monrovia enters regional clash knowing what to expect

Parke Heritage embraces 'underdog' role in upcoming regional

Parke Heritage embraces 'underdog' role in upcoming regional

Several contested races await Parke County voters

Several contested races await Parke County voters

ISP protect Hoosier kids from online predators

ISP protect Hoosier kids from online predators

Indiana BMV to offer Disability Blackout plate

Indiana BMV to offer Disability Blackout plate

U.S. Postal Service to observe Presidents Day, Feb. 16

U.S. Postal Service to observe Presidents Day, Feb. 16

Lucas Oil named title partner of 500 Festival Parade

Lucas Oil named title partner of 500 Festival Parade

Applications open for new United Way of Central Indiana initiative to build community solutions

Applications open for new United Way of Central Indiana initiative to build community solutions

Utilities District of Western Indiana REMC announces increases over next three years

Utilities District of Western Indiana REMC announces increases over next three years

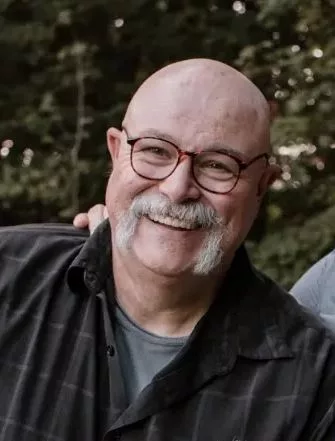

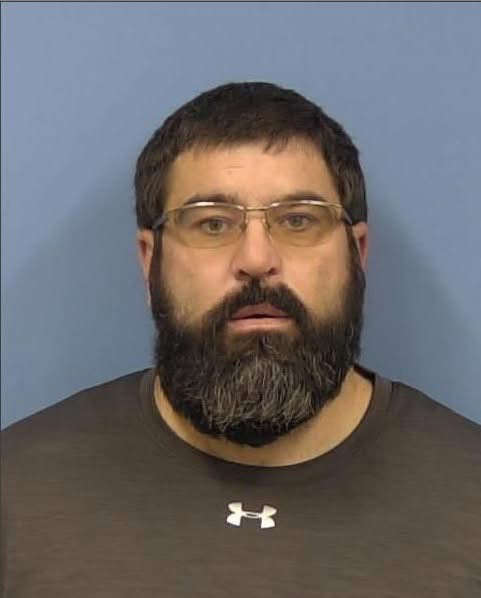

Fountain County man arrested on sex crime charges, Parke County investigation remains

Fountain County man arrested on sex crime charges, Parke County investigation remains

Friday is National Wear Red Day

Friday is National Wear Red Day

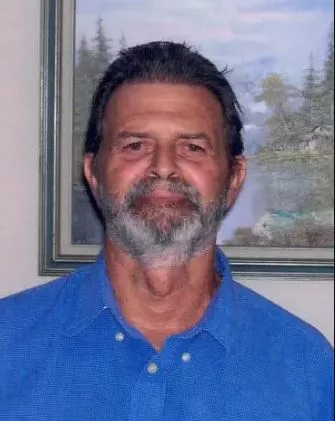

Vermillion County DCS worker facing felonies

Vermillion County DCS worker facing felonies

One week left to file for office in Indiana

One week left to file for office in Indiana

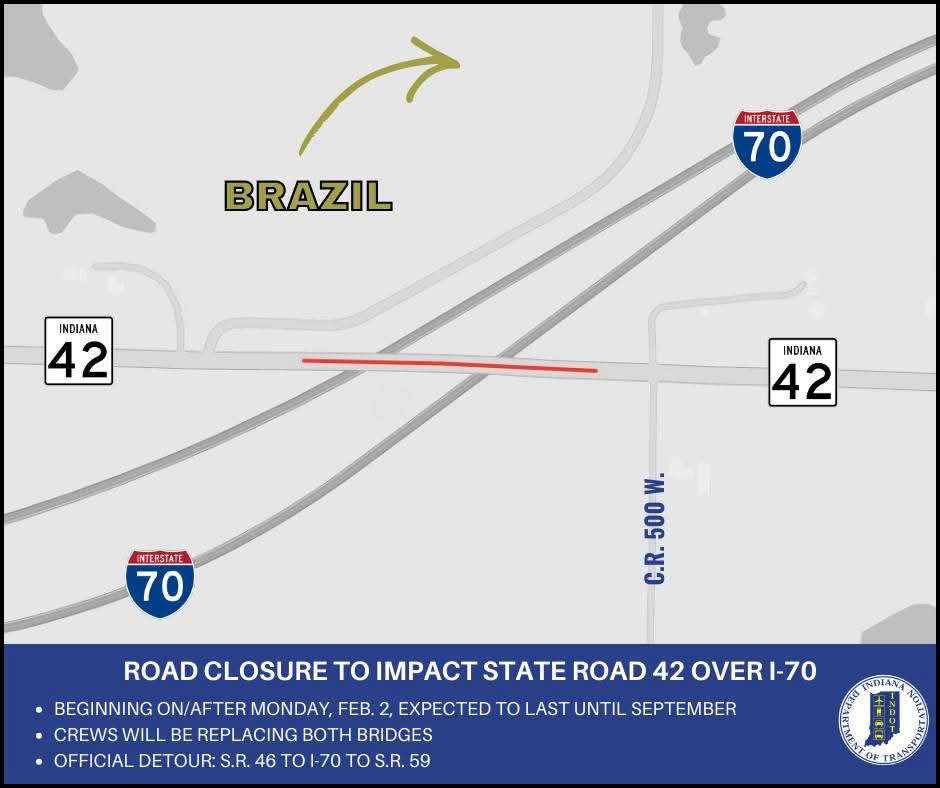

Bridge closures to impact State Road 42 over I-70 in Clay County

Bridge closures to impact State Road 42 over I-70 in Clay County